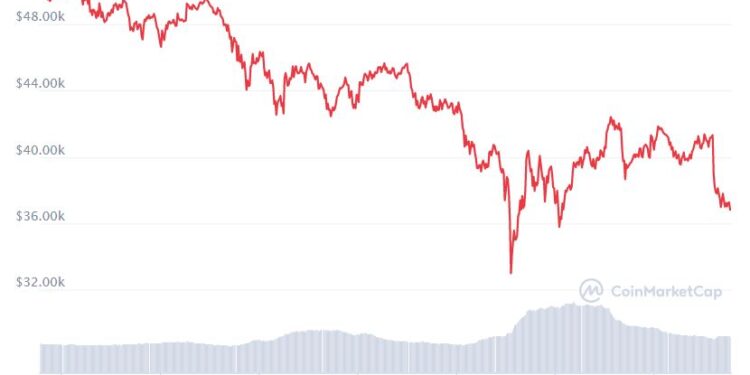

The whole world is consumed with bitcoin’s performance this week. Some people are cheering at the top of their lungs that bitcoin has fallen by as much as 30 percent while others are crying. In fact, the chief of crypto went down almost to $30,000 at one point on the 19th. But yesterday, it hung around in the upper $30Ks territory. You know, between $35K and $40K. Although it did jump over $40K briefly. The crypto market lost $600 billion in a week.

Still, everyone’s asking, “How much lower can bitcoin go?” Some are saying as low as $20,000. And I would say that’s not out of the question.

Nevertheless, there are some cryptocurrencies that are doing well with this crash. PAZZI is up15840.28%. TRST is up 2583.10%. And KNDC is up 891.57%. These figures are as of May 19 and courtesy of CryptoCart.

Other Crypto Stuff Worth Noting

Robinhood is offering $50,000 in free credits as the market tumbles. Maybe they’re trying to buy back user loyalty after the GameStop fiasco.

Sweet has something sweet to offer. They’ve expanded their NFT marketplace to Shopify.

Vitalik Buterin says we’re in a crypto bubble, says bitcoin could get left behind. Buterin’s baby Ethereum is planning to slash carbon emissions. Perhaps that is what this 27-year-old billionaire was alluding to. Oh yeah, the biggest fool in finance wants to tell you why you should pay attention to Ethereum.

The Ledger wallet revenues grew 500 percent in Q1. There must be a lot of people moving their crypto to safer vaults.

Meanwhile, did you know 42 percent of Americans believe cryptocurrencies will eventually replace fiat currencies? My view is a little more nuanced. I believe cryptocurrencies will someday be more popular than fiat money (33 percent of Americans own some now), but I don’t see governments giving up their control over monetary policy too easily. They’ll likely adopt central bank digital currencies (CBDCs), except for a few nations like Switzlerland, and CBDCs will exist alongside cryptocurrencies to provide people more choices and financial freedom. Americans, on the whole, are coming around to the realization that crypto is here to stay, evidenced by the fact that more and more are willing to receive crypto rewards. And I know how they can do it.

Outages at Coinbase and Binance show how fragile crypto exchanges really are.

How decentralized finance helps businesses.

Elon Musk impersonators have scammed $2 million out of people. In fact, crypto scams are on the rise. Meanwhile, the IRS and U.S. Treasury want stricter rules for crypto. And according to one opinionator, cryptocurrencies have not made the world a better place. Question: Who said they would?

U.S. Congressman Tom Emmer is pushing safe harbor legislation for crypto hodlers of forked coins.

700 million reasons the Dogecoin bubble will burst.

iMining, a Canada-based crypto company, is launching a staking product for Cardano. If that doesn’t make you want to be a cowboy, then I don’t know what does. Or maybe it should make you want to become a fitness guru, like Jillian Michaels, who has come out in favor of Cardano and Dogecoin. Hey, but that doesn’t make her a crypto guru.

Fed Chairman Jerome Powell has finally decided to open a crypto debate, which signals intent to regulate. Meanwhile, Real Money’s Jim Cramer wants to end the crypto madness.

And if you’ve been dying to know where crypto is legal and where it’s not, here’s the scoop. But it’s not ice cream so you can’t put it on a sugar cone.

Are NFTs a hot target for hackers? Of course, why wouldn’t they be? Anything new and different are going to attract a seedy element. Criminals are always the first to adopt new technology. Remember tommy guns?

Overheard on Twitter

Allen Taylor is a veteran award-winning journalist and former newspaper editor. He is a freelance writer focused on fintech, including blockchain and crypto projects, and manages crypto blogs through CryptoBloggers. Let’s connect on Twitter. His book about where crypto intersects with social media is due out this fall.

This post was first published on Substack.