Steemit will always be important to the cryptosocial sphere for one important reason: It was the first to market with a native cryptocurrency and the first cryptosocial platform to see its cryptocurrency, STEEM, rise to within the top 10 by market capitalization among all cryptocurrencies. Granted, the volatile nature of the crypto market makes that last achievement somewhat trivial, but it would be a mistake to trivialize the path that Steemit has paved for future cryptosocial platforms.

Launched March 2016, Steemit is based on the principle that user-generated content on social media websites should be compensated. Unfortunately, many users learned how to take Steemit’s greatest strength and turn it into a corrupt system of greed, much like junk bond salesmen do with the Wall Street capitalism.

STEEM has since fallen below the top 100 and will likely never see a return to market cap rank double digits.

What Is Steemit’s Greatest Strength?

According to Wired Magazine, by October 2017, the site had paid out $30 million in STEEM to 50,000 users. That’s an average of $600 per user. But most Steemit users haven’t earned anywhere near that. The same Wired article mentions one user who earned $41,000 in a few months.

An honest assessment of Steemit must point out that the success of first-generation users was due in large part to the bull run that saw bitcoin rise from under $1,000 in January 2017 to over $20,000 eleven months later.

The bitcoin bull market took the entire crypto market with it, including STEEM, which ended the year at $3.01, up from $0.1612.

Steemit’s compensation scheme is so complex one almost needs an advance degree in math to understand it. Bloggers post their content and voters upvote or downvote weighted partly by their Steem Power (the higher the SP the more one’s vote is worth) and partly on personal preference (although, this option is not available to new users).

After seven days, based on the number and weight of votes, content posters and upvoters receive a percentage of rewards in the form of STEEM and Steem Dollars, the platform’s native “stablecoin.” Steem Dollars were supposed to counterbalance the volatility of STEEM, but it didn’t work perfectly.

The idea behind SP was to stake one’s STEEM and keep it on the platform to strengthen the economy. If a user wants to cash out SP, they undergo a 13-week process called “powering down,” which transfers the SP back into liquid STEEM. The user can then convert STEEM into bitcoin or another cryptocurrency at a cryptocurrency exchange through a multi-step process.

But that isn’t Steemit’s great strength.

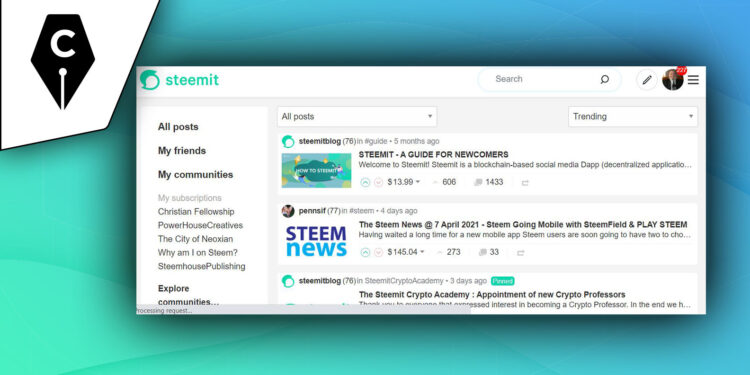

While users have an opportunity to earn value for their content, what sets Steemit apart from Facebook, Twitter, and the countless other centralized social media platforms is its underlying nature. Being a blockchain, anyone can build their own application on top of it. And many an enterprising Steemian did just that. In fact, many of the user-created applications (called dapps, or decentralized apps) worked better than the Steemit interface for posting content. And other dapps simply served a useful purpose. But there was one application that was particularly annoying and which served only to undermine the basic premise of Steemit–that users could earn cryptocurrency based on the quality of their content.

How Bidbots Destroyed Steemit

When I joined Steemit in March 2018, STEEM was at $1.83 and was No. 29 in the market cap standings. I also noted that its trending posts page was full of crap with very high earnings, but I didn’t know why that was the case at the time. I jumped into Steemit and started posting, and quickly learned how to promote my posts so that they earned a modest payout in an environment of declining STEEM value.

Steemit’s platform has a lousy user interface (UI), even today. Posting is clunky and non-intuitive. As noted earlier, most of the alternative posting dapps worked better than the native posting UI.

Because Steemit had no native networking tools at the time, users set up Discord communities for the actual networking. I found this to be rather disconcerting, although I did manage to find a few communities that were worth my time and which allowed me to build my following. That allowed my earnings to increase over time even though the value of those earnings steadily declined. An autovoting app allowed platform users to automatically upvote other users’ posts, which was efficient, but it meant that many of the upvotes I received for my posts weren’t read by the parties upvoting them (and I’ll admit that I also upvoted many posts I didn’t read).

One could argue that the autovote dapp was unethical, but, if used correctly, it was a handy tool. I made sure I could trust a person’s content before I added them to my auto-upvote list, but I’m sure many Steemians simply autoupvoted posts for the earnings they’d receive.

Far more deleterious were the bidbots.

Bidbots are computer programs that facilitate payment for upvotes. Steemians would place bids for the privilege of receiving an upvote. The person with the highest bidder would designate which post they wanted upvoted by the bot and the bot would visit their post at the appointed time and upvote it. This, in turn, resulted in autoupvotes by other users who followed that bot. Many users learned to use several bidbots simultaneously to drive up the number and value of their upvotes into the hundreds of dollars when their posts likely would have received no more than a handful of upvotes organically. The net result was STEEM and SBD diverted from users with higher quality content to users with lower quality content, which essentially undermined the entire premise of the platform.

There was a risk in using bidbots to upvote one’s content. If you overbid, you’d actually lose money. But if you bid just right, not only would you profit from the bidbot’s upvote, but the upvote was followed by the upvotes of other Steemians following the bidbot. It was a terrible racket and several alternative cryptosocial platforms have launched since for the sole purpose of excluding bots.

What Will Be Steemit’s Legacy?

Steemit fell apart in early 2020 when Justin Sun, founder of the Tron blockchain, bought the platform. Some of the witnesses blocked Sun’s access to company-staked STEEM. Sun, in return, installed his own witnesses. Not long after, the Steem blockchain forked and many high-profile witnesses created Hive as an alternative offering many Steemians Hive tokens equal to the amount of STEEM in their accounts.

Overall, what made Steemit a great place to blog was other Steemians. I made a few friends on the platform and will forever be grateful for the time I spent there. While I earned a modest return on my investment in time, the amount of time I spent on the platform far outweighed the value received. Still, I think Steemit will go down in history as paving a path to a whole new way of thinking about content posting on social media websites. People will be talking about Steemit for decades.

DISCLAIMER

I am not a financial advisor, nor do I give financial advice. The above information should not be considered financial advice but is for informational purposes only. Neither I nor Cryptowriter are responsible for financial losses incurred as a result of acting on this information. Please consult a financial advisor before making any financial decisions.

This post is published for Cryptowriter in association with Voice.

If you enjoyed this content feel free to use our ️EXCLUSIVE SIGN UP PAGE to skip the queue and gain full access to our Cryptowriter community.

Follow Our Socials – Twitter– Telegram– Instagram

Follow Me

➡ Cryptocracy Newsletter: https://cryptocracy.substack.com/

➡ Cryptocracy on Twitter: https://twitter.com/Cryptocracy3

➡ Allen Taylor Twitter: https://twitter.com/allen_taylor

➡ Taylored Content: https://tayloredcontent.com

➡ Cryptobloggers: https://cryptobloggers.us

This post was first published at Voice.